Your credit rating try a primary component that creditors, such as for example banking institutions, believe ahead of giving your for a financial loan. Your credit rating determines their borrowing limit as well as the interest rates offered to you due to the fact lower your credit history, the reduced the financing maximum while the large the speed was.

Ergo, with an effective 650 credit rating, you’ll likely qualify for that loan at the finance companies yet not in the less interest rate. But when you should not check out the financial, you can try additional options such as for instance poor credit or individual loan providers. They give you your a great deal more competitive loans however they are subject to highest rates.

Really traditional banking institutions will demand consumers to have a credit rating of around 680 to qualify for a mortgage fast cash loans in Teller. If the credit history are 650, you could potentially qualify for a mortgage however, during the a top focus speed. Furthermore, option lenders offer a mortgage within a higher interest rate and may also want security or an effective co-signer.

cuatro. Leasing a house Having an excellent 650 Credit score

Your credit score are a primary grounds specific landlords thought in advance of they’ll book to you personally. They normally use it to check on the creditworthiness and watch if you be eligible for brand new book percentage. During the a competitive business, clients with a high credit scores have a bonus more those with lowest credit ratings.

5. Obtaining work That have a beneficial 650 Credit rating

For folks who submit an application for a municipal service work or a situation in the monetary provider world, prospective employers could possibly get check your credit rating. They use it to test your feeling of economic responsibility and you can danger of misconduct to determine whether to hire your. Businesses may consider candidates that have reasonable credit ratings, but individuals with highest fico scores remain a far greater danger of securing work over people who have bad or reasonable scores.

six. Delivering a car loan Having an excellent 650 Credit history

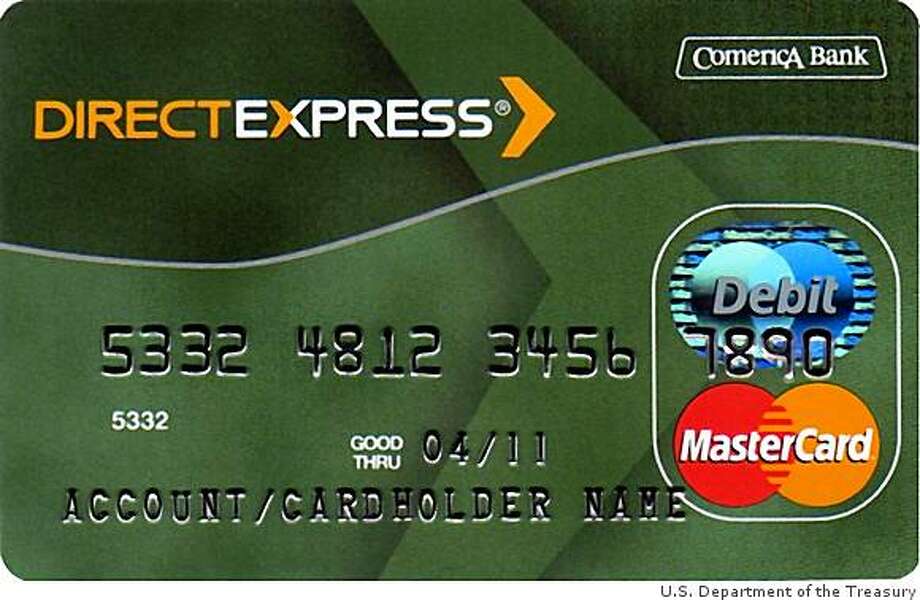

From inside the Canada, minimal credit score needed for an auto loan try anywhere between 630 in order to 650. Therefore, with a great 650 credit rating, you can easily be eligible for an auto loan as the automobile alone serves as security on the bank. In the event the leasing an automobile having a good debit credit instead of a good bank card, the newest leasing company might request your credit history to test and you will dictate your credit score.

seven. Getting a cell phone Having an excellent 650 Credit rating

Cellphone people look at your credit score too since it tells all of them even in the event you might handle monthly payments. Always, a rating away from 600 or reduced is seen as terrible, when you are a get out-of 650 or significantly more than is recommended because of the very providers. Whether your get is leaner, try not to stress. You’ll be able to only need to set-out more substantial deposit otherwise choose a prepaid service package, that may suggest investing more upfront however you will nevertheless manage to safer your brand-new mobile.

Putting it all together

A good 650 credit score isn’t the worst get during the Canada. They drops in reasonable listing of borrowing which is lower than the typical rating. Hence, with a great 650 credit rating isn’t the avoid around the world to you personally. You could potentially still qualify for of numerous borrowing solutions, even in the event more than likely perhaps not an educated of them. So you can qualify for top lending products in the straight down prices, work with enhancing your credit score.

That have an excellent 650 credit rating isnt terrible. Of a lot affairs have influenced it, like a recently available transfer to Canada, a history case of bankruptcy list, or you only have not had enough time to build a high credit history. Instead of impression bad regarding it, arise and take challenging measures to alter the fair borrowing from the bank get in order to a you to.

Leave a Reply