Buying a property was a major milestone in life as well as for of many nurses, it can be a daunting choice. As the a nursing assistant, you have unique monetary issues and it’s important to understand the procedure while the solutions for your requirements.

We will safeguards the basics of the home mortgage processes, the many brand of fund available, therefore the unique considerations for nurses. We are going to also have some suggestions and you will procedures to acquire the best package in your financial.

The house Loan Processes

Your house financing techniques is going to be complicated as well as overwhelming we understand it! nevertheless doesn’t have to be. The initial step is always to see the different varieties of funds readily available while the criteria for every.

The preferred types of loan to possess first home buyers are a changeable rates loan. Such loan is interested speed that may alter over time. It is critical to see the terms of the borrowed funds and just how the speed can alter.

The second sorts of loan try a fixed price mortgage. Such loan has an interest rate that’s repaired to have a certain time frame. This is certainly advisable to possess basic homebuyers just who need to protect a low-value interest to own a certain time frame.

The next style of financing try a variable speed mortgage. These financing is interested speed which can changes throughout the years, but the transform are limited. This might be advisable having earliest homebuyers who need to make use of a low interest rate, but do not wish to be met with the risk of a good large boost in the rate.

This new fourth types of financing try a combination financing. Such mortgage brings together a varying rate mortgage which have a fixed speed mortgage. This is exactly advisable for earliest homebuyers just who want to take advantage of a low-value interest, plus want the protection regarding a predetermined rate financing.

After you have selected the kind of mortgage that’s true getting your, the next thing is to apply for the mortgage. This involves submitting a credit card applicatoin on bank and you may providing the expected papers. The lender will likely then feedback the application making a decision.

Special Considerations to possess Nurses

Given that a nursing assistant, there are special factors to keep in mind whenever applying for home financing. The foremost is that you may be eligible for special discounts otherwise bonuses. Many loan providers offer discounts otherwise bonuses payday loan Clio AL so you can nurses, making it important to inquire about these whenever obtaining a financing.

The second reason is that you s. Of many loan providers offer unique mortgage apps to have nurses, such as for instance lower-notice fund otherwise deferred payment plans. It is important to find out about these whenever obtaining a loan.

The third is that you could be eligible for special tax positives. Of numerous loan providers promote tax positive points to nurses, such write-offs to possess mortgage attention otherwise possessions fees. It is vital to find out about these when trying to get that loan.

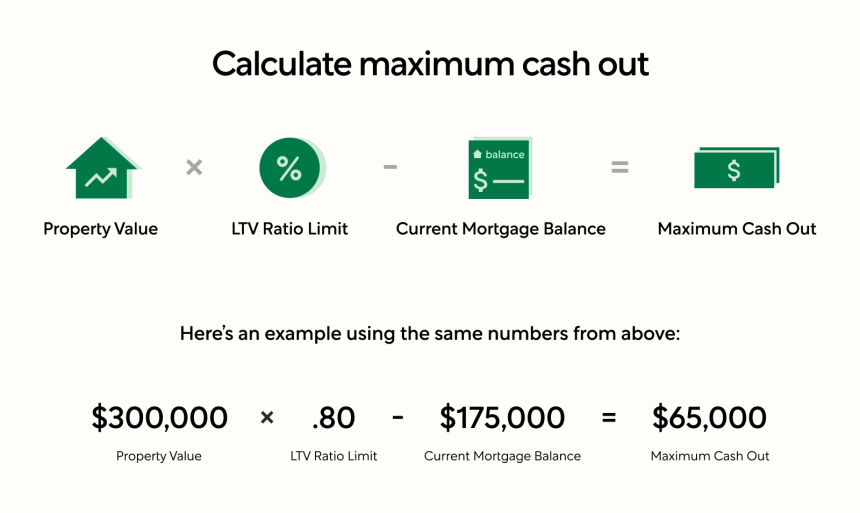

Finally and maybe first and foremost, of several loan providers offer LMI exemptions having nurses trying to get a property financing. Because of this you could potentially borrow through the normal 80% LVR threshold (understand establish a smaller deposit) and not have to pay Lender’s Home loan Insurance. Conditions apply needless to say however, which exclusion have a huge effect into the sort of property you can afford.

Tips and tricks

Now that you comprehend the basics of the property loan procedure while the special factors for nurses, here are some ideas and you can methods to obtain the newest lowest price on the financial.

Comparison shop More loan providers promote additional rates and you may words, so it is vital that you compare more lenders for the best package.

Negotiate You shouldn’t be frightened right here. Of numerous loan providers are willing to negotiate into the costs and you can conditions, therefore it is vital that you ask for a better offer. Having fun with a large financial company is best treatment for ensure that you will get a lot.

Get expert advice A large financial company can help you understand the process and find a knowledgeable deal for the condition.

Purchasing a property is a major milestone in daily life and of many nurses, it can be a challenging candidate. But with the right recommendations and information, it will not need to be. Develop this article could have been useful in understanding the household loan process and the unique factors for nurses.

At Mortgage Partners, we understand the initial financial items away from nurses and you can our company is here to assist. We’d prefer to respond to any queries you have which help you to obtain a home loan. E mail us today to begin.

Leave a Reply