Advanced CRM Have To own A smooth Sense

- Tune and you will perform the lead processes.

- See income accumulated.

- Song sales, remark performance and you will build relationships consumers.

- Send members some other borrowing products instantly.

- Improves customers sales, nurturing and you will maintenance that have instantaneous study retrieval and you may support possess.

- Comprehensive profile.

- Cutting-edge statistics and skills.

07.How can i effortlessly carry out and song the brand new updates of your own prospects?

Folks dreams of to invest in his or her own house. Property is generally the most expensive advantage a guy shopping in the or this lady whole lives. The value of the house is roughly 5-8 times the latest annual money men and women and therefore some body you would like an economic substitute for get a property.

So it funds provider one to banks and you may loan providers provide was a great financial. A mortgage fundamentally funds you with a lump sum payment equal so you can or lower than the value of your house thereby enabling you create the purchase. That it amount try paid down because of the some body returning to financial institutions otherwise creditors that have attention. . Read more

Bringing financing off a bank otherwise a lending institution is actually maybe not a facile task. It takes an abundance of documents, several go after-ups and you may experience in various available options. A home loan representative can make this action of getting a house loan simpler for you.

Who is home financing Agent?

Home financing broker are an individual that makes it possible to during the entire process of taking a mortgage right from initiation to the final disbursement of cash for you. The bank and standard bank have registered individuals who be the mortgage representatives. Specific financial agents are freelancers and they are maybe not of this people financial institutions.

A home loan agent contains the called for sense, degree and you may understanding of various choices for taking a mortgage and will guide individuals or companies to determine the right house financing choice that is suitable centered on their financial predicament and standards.

After you meet home financing agent, each goes through your borrowing profile, get the credit score statement and come up with extent out of financing a person is generally entitled to and various alternatives one to subscribers usually takes your house loan

Usually, financial agencies found subscribers individually and aided your in the whole casing loan procedure. not, recently, a lot of mortgage representative arrive payday loans online North Dakota around any kind of time time in aiding subscribers making use of their inquiries. For this reason, customers can apply for lenders on the web as well for the help of home loan representatives

Who will getting a mortgage agent?

Inside India, any Indian resident above the age of 18 which have at least qualification out of twelfth levels is approved becoming a mortgage broker.

Apart from the lowest training qualification, its questioned that home loan agencies are great in the interaction and you can marketing skills.

The capability to become familiar with selection, sympathize with subscribers and you will salesmanship are the fresh qualities from a great home loan agent. Is a home loan agent is additionally a side-occupation of several people that means no expense as such.

Benefits of To-be Construction Financing Broker which have Choices Connect

Just one looking to be a home loan broker demands brand new correct system in order to learn the different regions of domestic fund and you may visited for connecting which have clients of various corners from the country

Choices connect is actually a varied monetary conglomerate one allows individuals feel home loan agents instructed because of the ideal loan providers. Listed below are some of one’s pros you to definitely Solutions Hook brings so you can brand new table:

Produce another type of income source for lifetime- Associating having Choice Connect can help you end up being home financing agent that serve you that have an inactive income source having a lifestyle.

Autonomy The fresh new paperless and you will cutting-edge user interface on Choices Link makes it possible to with the flexibleness in order to make work from anywhere and you may when based on their comfort.

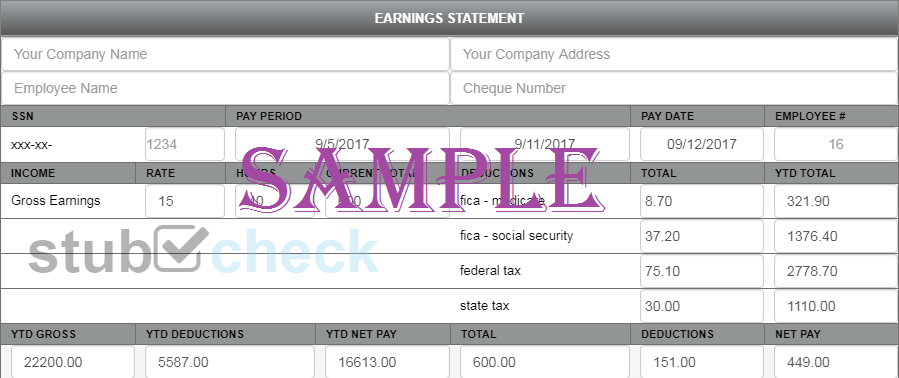

Entry to state-of-the-art CRM Choices Hook provides committed to a high-high quality CRM that assists mortgage agents’ song almost all their guides towards a bona-fide-time base to aid agents to the workflows of each and you will all the client within a follow this link regarding a computer button.

Clear without Deposit Several establishments ask for places to be home loan agencies. Options Link is just one of the partners trusted brands in the sector that can help you become a mortgage broker without the profits and assists your work in a totally clear fashion.

How to be Home loan Representative

Additional networks features different methods to join up because a home loan representative. Getting home financing agent with the Solutions Hook Program was extremely easy and the process comprises 4 measures:

While the smartphone and current email address was confirmed, you will want to enter your very first advice as well as your target. During this action, you also need to enter in their Long lasting Membership Number of Dish.

Post feeding the basic information, you really need to put the term facts and you can upload a soft copy of title proof.

Once your records is uploaded and verified of the Choices Link, youre good to go and you may log in to the computer and start taking ideas.

Leave a Reply