Pricing & Terminology

- A good 720 credit score

- Financing-to-worthy of proportion regarding 70% for House Collateral Credit line (HELOC)

- Financing-to-really worth proportion out-of 50% to possess a home Guarantee Mortgage

The interest rate or margin you’ll be able to be eligible for is dependant on issues as well as your credit history while the mutual mortgage-to-really worth (CLTV) in your home. At least borrowing from the bank being qualified score needs. Applications online installment loans Wyoming, costs, APRs, factors and words here are effective as of 9/ consequently they are susceptible to changes without warning. Most of the money is subject to approval. Apr = Annual percentage rate.

Fee advice dont through the price of property taxation otherwise insurance policies, therefore the real fee obligation could be deeper. See additional Very important Meanings and you will Recommendations lower than.

Typical Domestic Guarantee Financing and you will House Equity Line of credit operating day was forty five months of submission off an application in order to investment.?

To apply, see our very own website at the , phone call the true Home Lending agencies on (800) 462-8328, ext. 8288, or email address united states from the

Debtor is responsible for accommodation recording costs, name charge to clear otherwise transfer liens, or indemnification due to construction on the subject assets.

step one Annual percentage rate = Annual percentage rate. Speed is fixed for 5 years, variable after that. dos Owner-filled top homes, out-of $ten,000 in order to $500,000. Non-owner filled qualities, of $ten,000 to $150,000. step three CLTV = Shared Loan-To-Worth

Practical Home Equity Personal line of credit (HELOC)

Limited-go out venture: Because of , get a standard HELOC and you will qualify to delight in a speed as little as 6.99% Annual percentage rate for the improves and you may stability having 6 months immediately following financing. Pursuing the six-week period, balance and you may upcoming advances would be subject to the new HELOC varying rates essentially during the time. The speed you can also qualify for is dependant on the creditworthiness or any other activities. Currently, its only seven.50% Annual percentage rate. Only a few people have a tendency to qualify for new six.99% Apr. The six.99% marketing and advertising rate is not designed for local rental attributes otherwise next home and should not be used into Rates Virtue HELOC. Which promotion is obtainable to have Standard HELOC programs recorded zero later than just .

Abreast of expiration of your basic speed, the HELOC balances commonly accrue focus in the adjustable Apr for the feeling during the time.

step 1 Annual percentage rate = Apr. Repayments do not were numbers having fees and insurance fees, if the appropriate, the true commission obligation was deeper. 2 Holder-filled primary houses, out of $ten,000 so you can $five-hundred,000. Non-owner occupied services, off $10,000 to $150,000.

Very important Significance and you will Advice

Family Security Personal line of credit (HELOC): An unbarred credit line your borrow against the brand new security when you look at the your property and you will mark funds from as you need.

Index Price ‘s the most recent high “best price” just like the stated from the Wall structure Road Journal on history team day’s new day before the start big date each and every charging you years.

Yearly Repairs Percentage to have HELOCs: $fifty. Payment could well be waived if repayments was immediately directed out of a great SchoolsFirst FCU Show Savings or Savings account.

Family Equity Mortgage and you will HELOC Origination Costs: Zero bank origination fees are required except if holiday accommodation recording fees, identity charge to pay off otherwise transfer liens, otherwise indemnification because of construction about them possessions are essential. This new debtor is in charge of these types of can cost you.

Qualified Property Products: Single family unit members residence, condominium and you can Organized Tool Innovation (PUD). Manufactured property are eligible to have family equity money only. Restrictions affect multi-tool and you may money features. Possessions need to be based in Ca.

Property Design/Sale: The latest debtor is required to wait until financing financing try obtained to begin work with the house. A house having build already happening is almost certainly not eligible. If recognized, more charges are required. Features currently noted available aren’t qualified.

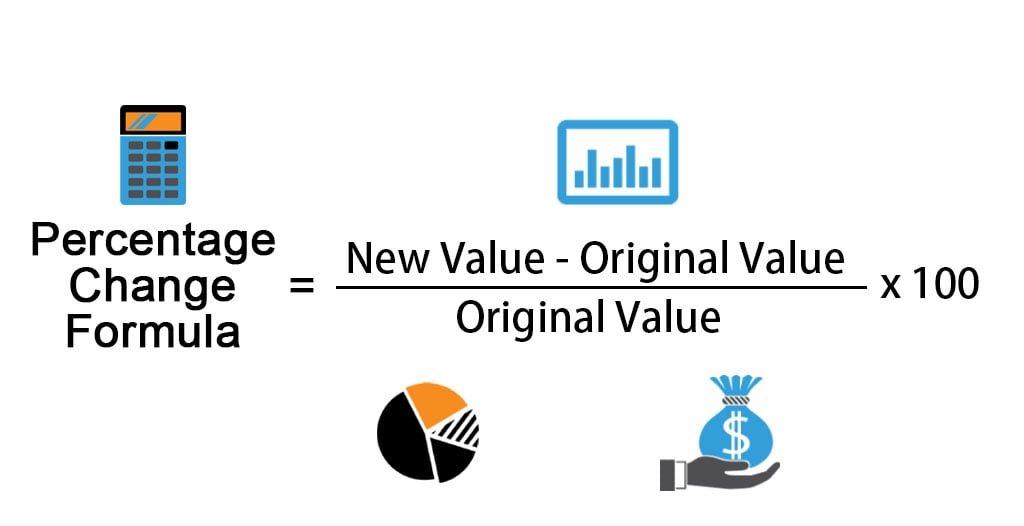

Restriction Mutual-Loan-To-Really worth (CLTV): The primary equilibrium of all the mortgages towards the property (like the equilibrium of your first-mortgage) separated by property value the property. Maximum CLTV having a beneficial condo or attached PUD is 80%.

Possessions Insurance policies: An important insurance plan that give defense to the borrower against losings or damage and to the newest lender’s interest in the house.

You will be making our website

Because it is not the website, i’ve no command over the content, whether it is available, or if backlinks work properly. By giving which link, we are really not promoting one guidance, goods and services you may find indeed there.

Leave a Reply