- Reasonable apr inclusive of rates

- Higher loan amounts

- Versatile conditions

- Much time installment several months

- Excessive recommendations requisite

- Steady income source a top priority

Extremely credit platforms deliver the money within days, therefore we had to read the pair you to definitely deliver within days or a day at most

It is common so you can ask yourself exactly what requirements i always dig through the firms and you can arrived at a knowledgeable of those. We seemed what verified consumers said on many companies together with get of the features. After that, we picked a number of factors to allow us to decide whether or not or perhaps not for every company want to make it record.

Very first, i appeared individuals loan words applicable for each platform. The businesses has other terms for making use of the systems. So, we seemed and that offered an educated terminology and you can opposed these to anybody else. Including, i featured just what users had to say in the people words so you can make certain they certainly were not only words in writing.

Second, we check the offered mortgage amounts. For each business offers a special sum, and now we considered the fresh new you’ll purposes for these types of money. An inadequate loan contribution try useless, particularly when you’ll find extra fees you to lenders will get subtract out-of the money.

Additionally, committed from birth is imperative to and this companies we chose. New faster you receive the cash, the greater of use it becomes when you look at the an emergency.

On top of that, i checked-out the eye costs each and every providers mainly because prices helps make or mar the mortgage. Bad credit financing normally focus large-rates of interest, very seeking organizations having sensible cost was not a walk-in the newest park. Although not, we discover a few to help ease your possibilities procedure.

- Mortgage Terms: Not every loan name is actually advantageous, especially for poor credit users. Thus, i chosen on line financing systems offering the best pricing and do not have invisible charge that may change the mortgage.

- Mortgage Sums: Also essential ‘s the number available to bad credit consumers. Almost every lender doesn’t supply the overall loan sum in order to such consumers, so we must guarantee the currency is adequate to protection costs.

- Beginning Go out: I made use of the birth time for you thin record after that. As the said, quicker this new beginning day, the better the mortgage. You could put it to help you a good explore while in an economic crisis.

- Rates of interest: Ultimately, we selected the newest systems most abundant in practical rates of interest. You will not want in order to services financing which have exorbitant attract as it might cripple your earnings.

To find Book: Selecting the Most readily useful Less than perfect credit Money

Numerous factors tell your choice to choose a specific credit system if you’d like a bad credit financing. Yet not, you need to imagine particular choosing things which can make otherwise mar the mortgage in advance of compromising for any lender.

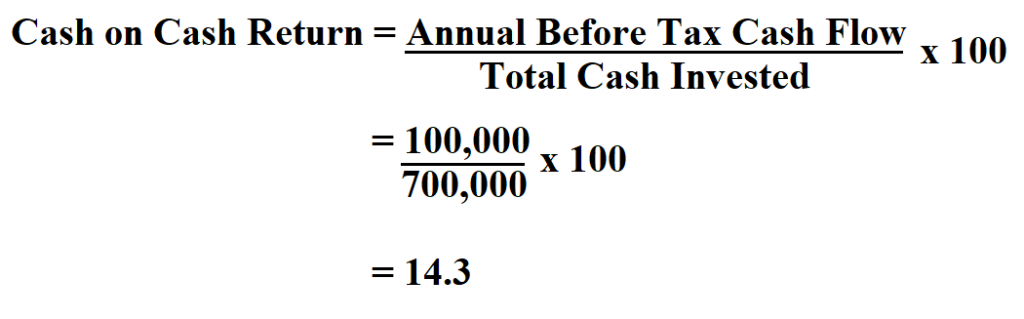

Which grounds is perhaps the most important grounds because it can rather enhance the count your pay-off in the mortgage termination. The same applies to this new apr (APR). That’s why in search of a lender having flexible prices is vital for how the borrowed funds performs. Certain loan providers use markets cost, although some has a more secure speed. You are able to like a loan provider which have a reliable price to end changing quantity affecting your revenue.

The content of your financing words can impact how well your manage the new package. For the majority of lenders, you can find generally invisible charge that appear in case it is date when planning on taking the borrowed funds. Like charge cover anything from an origination percentage, that lender deducts from the mortgage. Some other are later commission costs, which also come from the borrowed funds.

Leave a Reply