A home loan pre-recognition should be thought about for those to get a house. Home loan pre-recognition of a lender gets buyers a concept of what they is also obtain which hence qualities they could rationally manage. The house or property industry can be hugely competitive, and you can a pre-acceptance indicates to help you real estate agents your a serious competitor after you find a house. It would and then make feel one to a purchaser having several pre-approvals would reputation on their own once the a level stronger competitor. Certainly a number of pre-approvals increases a buyer’s possibility of indeed with at least one bank officially agree its software? Whilst reason are sound, the exact opposite is valid.

Applying for numerous pre-approvals doesn’t replace your condition since a purchaser and you may indeed not as a borrower. Let us evaluate how a pre-recognition software impacts your credit score and just how obtaining numerous pre-approvals can actually features a poor affect your credit history and you can score.

What is actually a credit history?

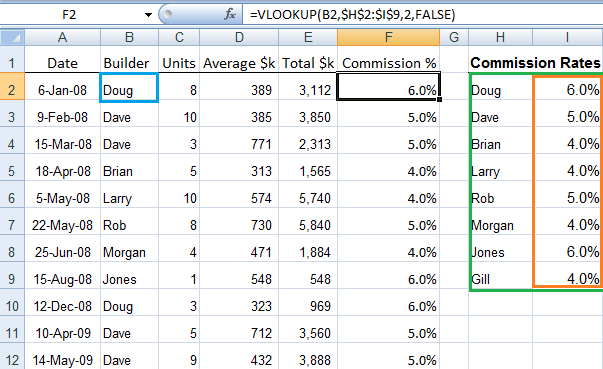

Your credit score is several you to definitely means so you’re able to a loan provider the danger working in credit money to you. A credit rating is based on analysis of your own personal borrowing declaration which has:

A credit score is actually submitted because of the federal credit scoring authorities (CRBs). According to the credit rating system, your credit score are lots ranging from 0-1000 or 0-1200. A high matter corresponds with a good credit score and you will low chance so you’re able to loan providers when you find yourself a low matter was a sign out-of good less than perfect credit records hence a premier risk so you can lenders. The financing score matter was scaled into one of four classes filled with below average, mediocre, a, decent and you will advanced.

Exactly who establishes my personal credit rating?

Credit rating authorities collect research off loan providers to make your private credit report. What found in your credit history will be regularly create your credit rating.

You should check your credit score free-of-charge using a number out-of on line team. It must be indexed that we now have five different credit scoring regulators one operate in Australian continent and you can a credit score can vary based and this credit rating body has been utilized. To own an exact picture of your credit score you should check your credit rating with more than you to definitely vendor.

What are the benefits associated with examining your credit score?

Credit reporting solutions aren’t infallible, and you can problems would occur. Detecting errors early prior to they impact on your financial situation was a major advantageous asset of examining your credit score. In the event your rating looks oddly lowest, you could potentially consult a copy of credit history and look that info was right. Pointers found in your credit report tends to be completely wrong, out-of-time, unfinished otherwise irrelevant.

If this is the situation, you will want to get in touch with the financing reporting department to get the question resolved. Given you really have research, you are legally entitled to has incorrect recommendations altered.

If you discover problems on your credit file, such as for example software to have borrowing which you don’t build, it can be that a person is utilizing your own term to apply getting credit. Which practice is on the rise and securing oneself away from title theft is yet another cause to evaluate your credit score.

It is also good for check your credit history before you could submit a beneficial pre-acceptance application as it can certainly make a big https://paydayloansalaska.net/eielson-afb/ change into count a lender is ready to provide you. If you find which you have a low credit score, it is a smart idea to waiting to the any pre-recognition software. Rather, you will want to spend the go out enhancing your credit rating. Making an application for borrowing which have a high credit history can help you safe a far greater interest and you can a better economic device.

Leave a Reply